Business insurance is an essential shield for organizations, safeguarding them from monetary misfortunes because of startling occasions. Whether you work in a tiny small startup or an enormous enterprise, dangers, for example, property harm, risk claims, representative wounds, or cyberattacks, can upset tasks and compromise your business’ security. Business protection gives a well-being net, permitting organizations to recuperate from mishaps and keep working with insignificant monetary strain.

There are different sorts of business protection custom fitted to explicit necessities, including general responsibility, property protection, laborers’ remuneration, and expert obligation. Every strategy is intended to address remarkable dangers, guaranteeing extensive inclusion for assorted ventures and plans of action. Also, specific protection choices, such as digital risk or business interference protection, take care of current difficulties in a developing commercial center.

What is Business Insurance?

Business insurance is a comprehensive scope of contracts intended to shield organizations from likely monetary misfortunes caused by unexpected events. These events can range from property harm, liability issues, and worker wounds to business interferences and numerous other dangers.

The primary role of business protection is to assist organizations with limiting the effect of these dangers by giving monetary pay, lawful assurance, and backing for recuperation after misfortunes. Business protection covers different parts of business tasks and can be tweaked to meet the novel requirements of the organization, whether minor, medium, or enormous.

Types of Business Insurance

Various types of business insurance cater to different risks and aspects of running a business. Below are some of the most common types:

- General Liability Insurance: This is one of the most essential types of insurance for businesses. It provides coverage in case your business is other harm to third parties (such as customers, suppliers, or even the public). General liability insurance helps with legal costs, settlements, and damages.

- Property Insurance: This covers physical assets owned by the business, such as buildings, equipment, inventory, and supplies, from damage caused by events like fire, theft, vandalism, or natural disasters. Property insurance can help pay for repairs or replacements.

- Workers’ Compensation Insurance: Workers’ compensation insurance provides coverage for employees who are injured or become ill while performing their jobs. This insurance covers medical expenses, rehabilitation, and lost wages. In many places, it is required by law for businesses with employees.

- Business Interruption Insurance: Business interruption insurance (also known as business income insurance) helps businesses recover lost income due to events that disrupt everyday business operations. This could include situations like natural disasters, fires, or other unexpected closures. It covers lost profits and operating expenses during the recovery period.

- Commercial Auto Insurance: If a business uses vehicles for work purposes, commercial auto insurance covers vehicles against accidents, theft, or damage. This includes coverage for both company-owned and employee-owned vehicles used for business activities.

- Product Liability Insurance: This type of insurance is essential for businesses that manufacture, distribute, or sell products. It covers the cost of claims resulting from injuries or damages caused by defective products. Product liability insurance helps businesses manage the financial risk of a lawsuit due to their products causing harm to consumers.

- Professional Liability Insurance (Errors and Omissions Insurance): This insurance is designed for businesses that provide professional services or advice, such as consultants, lawyers, accountants, and doctors. It protects against claims made by clients for errors, omissions, or negligent advice that leads to financial losses for the client.

- Cyber Liability Insurance: In today’s digital world, cyber liability insurance is increasingly important. It protects businesses against data breaches, cyber-attacks, and other forms of digital threats. This type of insurance helps businesses recover from losses related to compromised data, such as customer information, intellectual property, or company secrets.

- Directors and Officers Insurance (D&O Insurance): D&O insurance provides coverage for the personal liabilities of a company’s directors and officers. This insurance protects business leaders from lawsuits resulting from their decisions and actions while running the company, such as allegations of mismanagement, breach of fiduciary duties, or regulatory violations.

- Umbrella Insurance: Umbrella insurance provides an extra layer of protection beyond the limits of other primary policies like general liability or auto insurance. If a claim exceeds the coverage limits of your existing policies, umbrella insurance helps cover the remaining costs, protecting your business from significant, unexpected losses.

- Employee Benefits Insurance: This includes insurance that covers employee-related benefits such as health insurance, life insurance, disability insurance, and retirement plans. These benefits help attract and retain employees while providing essential support in case of health issues or death.

- Trade Credit Insurance: Trade credit insurance is designed to protect businesses from the risk of customers’ non-payment. This is particularly important for businesses that extend credit to their clients or customers. If a customer fails to pay their outstanding invoices, trade credit insurance covers the loss.

Key Components of Business Insurance Coverage

A well-rounded business insurance policy typically consists of various components, including:

- Policy Limits: These define the maximum amount the insurance company will pay for a claim. This could be per incident or on an aggregate basis for the policy term.

- Premiums: The amount the business must pay periodically to maintain coverage. Premiums vary depending on the type of insurance, coverage limits, business size, industry, and risk factors.

- Deductibles: This is the amount the business needs to pay out-of-pocket before the insurance company begins to cover the costs. Higher deductibles generally lead to lower premiums, but companies must be prepared to pay these deductibles when claims occur.

- Exclusions: Each insurance policy includes specific exclusions, which are risks that the policy does not cover. It is crucial to review these exclusions to avoid surprises in the event of a claim.

- Add-Ons and Endorsements: Businesses can often customize their coverage with additional endorsements or add-ons to cover specific risks unique to their operations.

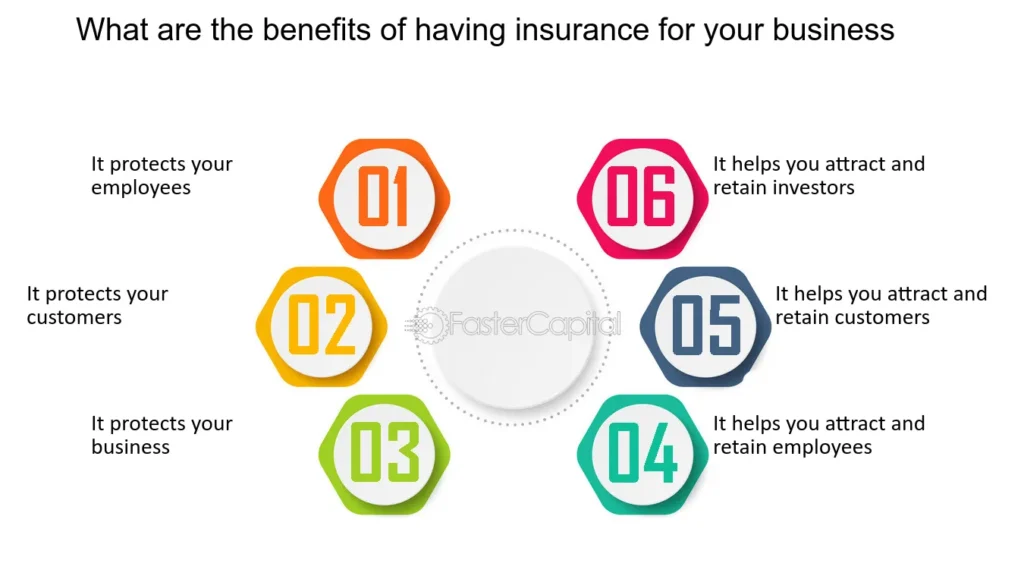

Benefits of Having Business Insurance

- Risk Mitigation: Insurance reduces the financial impact of unexpected events that could threaten the continuity of your business. Whether it’s a property loss, a lawsuit, or a worker’s injury, business insurance helps mitigate these risks.

- Legal Protection: In some cases, businesses can be legally liable for accidents or injuries. Having the right insurance, such as general liability or professional liability, helps protect against expensive lawsuits and legal fees.

- Business Continuity: Certain types of insurance, such as business interruption insurance, help ensure that a business can continue operations even after a disaster or event causes temporary disruption. This enables a business to survive and recover from difficult circumstances.

- Employee Security: Workers’ compensation, health benefits, and other forms of employee insurance offer protection for your employees, ensuring they have medical care and financial support if they become injured or ill while working.

- Peace of Mind: Knowing your business is protected from the most common and costly risks gives business owners peace of mind, allowing them to focus on growth and day-to-day operations without worrying about potential financial setbacks.

How to Choose the Right Business Insurance Policy

Choosing the right business insurance policy depends on several factors. Here are some key steps to consider:

- Assess Your Risks: Every business faces unique risks, depending on the industry, size, and operational scope. Identifying your business’s vulnerabilities will help you determine which types of insurance are essential. For example, a manufacturing business may need more robust property and product liability coverage, while a tech company may prioritize cyber liability insurance.

- Evaluate Coverage Needs: Determine the amount of coverage your business needs. You’ll need to consider the value of assets, the number of employees, the nature of your products or services, and any legal or regulatory requirements for insurance.

- Compare Policies and Insurers: Not all business insurance policies are the same. Compare offerings from different insurance providers to ensure you’re getting the best value for your money, considering both coverage and premiums.

- Understand Policy Exclusions: Carefully read the exclusions section of any policy to make sure it covers what you need and that you’re not left unprotected from any significant risks.

- Please consult an Expert: It’s advisable to speak with an insurance broker or advisor who specializes in business insurance. They can help you navigate the various options and recommend a policy tailored to your specific needs.

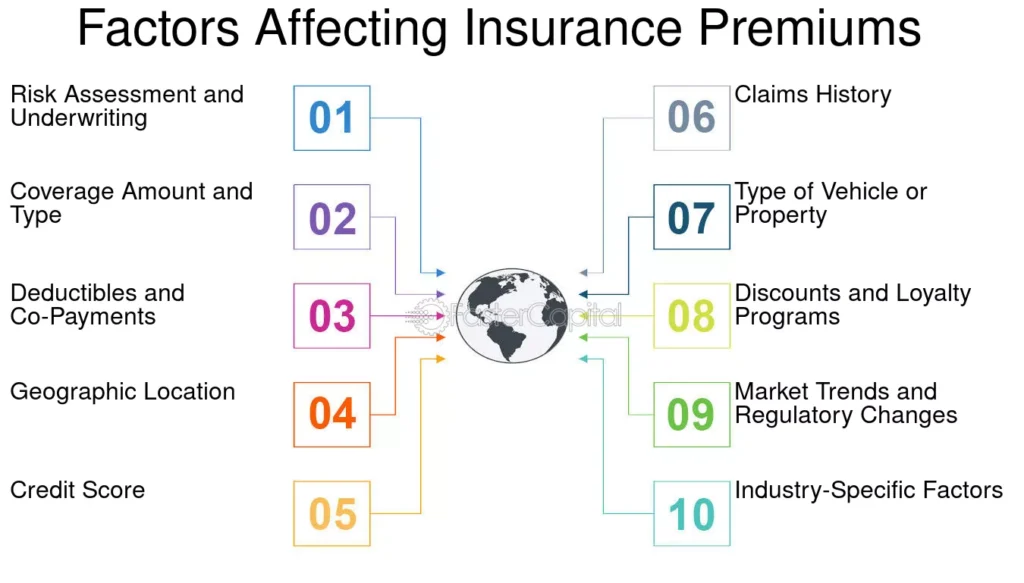

Cost of Business Insurance and Factors Affecting It

The cost of business insurance can vary widely depending on a number of factors:

- Industry Type: Certain industries are considered higher-risk and, therefore, attract higher premiums. For example, construction businesses are generally more expensive to insure than office-based businesses.

- Business Size and Revenue: Larger businesses or those with more employees typically pay higher premiums due to the greater risk exposure.

- Coverage Amount: The higher the coverage limits, the more expensive the insurance. Businesses must strike a balance between adequate coverage and affordable premiums.

- Claims History: Businesses with a history of frequent claims may face higher premiums, as they are seen as a higher risk by insurers.

- Location: Some regions have higher insurance costs due to factors like local regulations, crime rates, or natural disaster risks.

- Deductibles: A higher deductible often means lower premiums. However, businesses should ensure they can afford the deductible in the event of a claim.

Common Myths and Misconceptions About Business Insurance

- “I don’t need insurance because my business is small”: Small businesses are still at risk for unexpected events, and insurance helps protect against potential financial losses.

- “My business is covered under my home insurance policy.” Home insurance typically doesn’t cover business operations or business assets, so separate business insurance is necessary.

- “Business insurance is too expensive”: While premiums vary, many businesses can find affordable insurance options that offer essential protection without breaking the bank. Shop around to find the best policy for your budget.

- “I’ll be fine without liability insurance”: Liability claims can be financially devastating, and businesses without adequate coverage may be forced to pay out of pocket for legal fees, settlements, or damages.

The Importance of Regularly Reviewing Business Insurance

Business needs and dangers advance over time, and it is fundamental for entrepreneurs to audit and refresh their insurance contracts consistently. Changes in the industry—like extension, recruiting new workers, or presenting new items or administrations—may require adaptations to your inclusion to guarantee you remain satisfactorily secured.

Why do you need business insurance?

Business protection is significant for business people since it can safeguard against the risk of employees losing work or even personal injury. Many kinds of business protection are available; however, some fundamental inclusions ought to incorporate property protection, public responsibility protection, and worker pay.

It’s vital to get the proper coverage for your needs and objectives prior to starting a business or going independently employed. Business protection can take many forms, with numerous degrees of security depending upon the degree of risk you need to be lawfully safeguarded from.

Do I need business insurance for an online business?

You must ensure your business has the proper inclusion set up to safeguard both you and your organization. Business Interference Protection covers lost pay because of transitory conclusion of activity, catastrophic events like floods or seismic tremors, or broken gear.

For instance, if gear fizzles during a bustling Christmas season and blocks creation for half a month until it tends to be fixed or supplanted, could you have sufficient cash set aside to cover the bills? How long might you at any point do without the pay from deals? This should be considered while contemplating whether an insurance contract is required.

Frequently Asked Questions

What is business protection?

Business protection is a type of insurance that safeguards organizations from financial losses caused by unexpected events, such as property damage, claims, employee injuries, or cyberattacks. It guarantees that organizations can recover and proceed with tasks with negligible interruption.

Is business protection required?

A few sorts of business protection, like laborers’ remuneration, are legitimately expected in numerous locales. The particular prerequisites rely upon the area, industry, and number of workers.

What amount carries on with the work protection cost?

Costs fluctuate depending on factors such as the size of the business, industry opportunities, inclusion cutoff points and claims history. Private ventures might pay a couple hundred bucks yearly, while more prominent organizations with complex risks might pay substantially more.

Carries on with work protection to cover cataclysmic events?

Standard property protection may not cover catastrophic events like floods or quakes. Organizations can buy extra inclusion or particular strategies to safeguard against these dangers.

Could locally established organizations get protection?

Indeed, locally established organizations can be included through specific arrangements or by adding support to property holders’ protection. This guarantees assurance for business gear and responsibility opportunities.

How would I pick the proper business protection?

Evaluate your business’s risks and talk with a protection specialist or merchant. Consider industry-explicit necessities, legitimate prerequisites, and the expected monetary effect of other hazards to choose the appropriate inclusion.

How does carry-on with work interference protection work?

Business interference protection makes up for lost pay and working costs when a covered

occasion, similar to a fire or tempest, powers the business to close briefly. It keeps up with monetary strength during recuperation.

Conclusion

Business protection is an imperative device for shielding an organization’s resources, workers, and notoriety. In an erratic world, organizations face various dangers, going from claims and property harm to cyberattacks and cataclysmic events. Without satisfactory protection, these occasions can prompt critical monetary strain or even power a business to close. The proper insurance contracts give monetary security and cultivate certainty among partners, including representatives, clients, and financial backers. By guaranteeing consistency with lawful prerequisites and tending to industry-explicit dangers, business protection upholds functional coherence and versatility.