Entire extra security is a type of long-lasting disaster protection that covers the whole of your life, regardless of how long expenses are paid. Dissimilar to term life coverage, which lapses after a set period, entire life coverage offers deep-rooted insurance and builds cash value over the long run. This cash value develops at a surefire rate, offering policyholders a monetary resource they can get against or use in crises.

One of the critical benefits of entire-life coverage is its stability. Charges are fixed and don’t increment as you age, giving unsurprising costs throughout your life. Furthermore, the strategy’s demise benefit is ensured, guaranteeing that your recipients will get a payout upon your passing, paying little heed to when it happens.

Entire extra security is often thought of as a drawn-out monetary device for providing a death benefit and for its capacity to accumulate cash esteem. Money esteem develops on a duty-conceded premise, meaning you don’t pay charges for the development until you withdraw it. This can be especially important for home preparation or as a wellspring of crisis reserves.

What is Whole Life Insurance?

Entire disaster protection is long-lasting extra security that ensures lifetime inclusion for however long charges are paid. These strategies not only give a demise advantage to your recipients but also construct money esteem over the long run. The money esteem develops at a reliable rate, and the strategy stays dynamic for the whole lifetime of the safeguarded, unlike the term disaster protection, which lapses after a set number of years. This drawn-out nature makes it an alluring choice for those searching for deep-rooted insurance and a venture part.

How Does Whole Life Insurance Work?

Entire life coverage works by charging the policyholder fixed expenses throughout their life. These charges are divided into two sections: one piece takes care of the expense of protection, which guarantees the demise benefit is paid upon the policyholder’s passing. In contrast, the other part adds to the aggregation of money esteem. Money esteem collects on an expense-accounted premise, meaning you don’t pay charges for it until you pull out or get from the money esteem. Furthermore, the strategy offers a dependable passing advantage, which continues as before over the lifetime of the policyholder.

After some time, the money value develops, giving the policyholder a resource that can be accessed through advances or withdrawals. While the death benefit is ensured, the money value part offers some adaptability, making the entire extra security unmistakable from different types of protection.

Premiums: Cost and Structure

Expenses for entire life coverage usually are higher than those for term life arrangements since entire life coverage gives super durable inclusion and incorporates the highlight of money esteem. These charges are fixed, meaning they continue as before sum over the lifetime of the policyholder. For more youthful people, this can be gainful, as the expense stays stable even as they age.

In the early years, a more significant piece of your top-notch will go toward the expense of protection and managerial charges, with a more modest part adding to your money esteem. Over the long run, as the strategy’s money esteem grows, a more significant piece of the premium is coordinated toward the collection of money esteem.

The entire extra security expense, noses, is generally organized to be paid over a period—regularly 10, 20, or until the guaranteed arrives at a specific age. At times, a policyholder can settle on a settled-up strategy, where expenses are not generally needed after a particular period; however, the passing advantage and money esteem keep on developing.

Cash Value Accumulation

A critical element of extra security is money esteem gathering. Money esteem is a part of your superiority that develops at a reliable rate set by the insurance agency. This money esteem is charge conceded, meaning you won’t pay charges on the profit until you pull them out or take a credit against it. Over the long haul, the money can be gathered, giving a monetary resource that can be used for different purposes.

Cash esteem development can take quite a long time to become significant, and it is regularly delayed in the beginning phases of the strategy. However, as the strategy ages, the money esteem proceeds to develop and can provide a significant wellspring of assets for the policyholder. Cash worth can be utilized in more than one way: the policyholder can pull out reserves, apply for a new line of credit against the money worth, or even use the cash worth to pay charges.

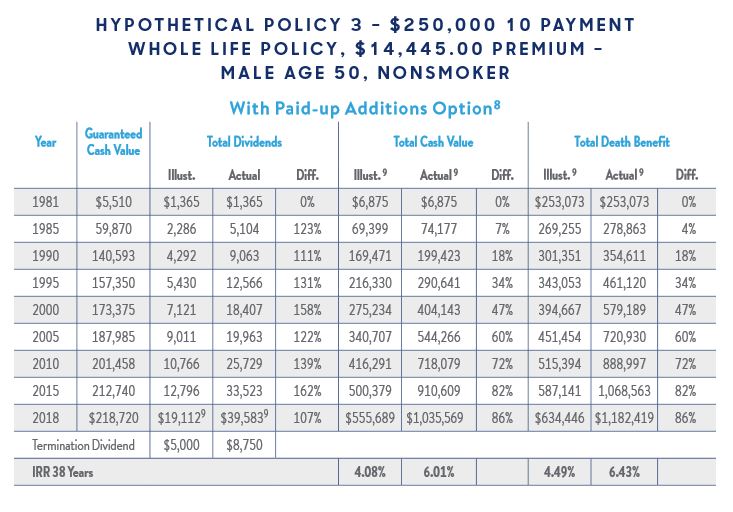

Dividends and Profit Sharing

Numerous extra security approaches are “taking part” arrangements, which implies they are qualified to receive profits from the insurance agency’s benefits. These profits are not guaranteed yet and can be utilized to upgrade the approach’s worth. Policyholders have a few choices for how to use profits: they can be applied to decrease charges, buy extra inclusion, or be taken in real money.

Profits are regularly at the level of the strategy’s premium or money worth, and they rely upon the backup plan’s monetary exhibition. While profits are not guaranteed, they can give policyholders an extra monetary advantage, expanding the money’s worth or death benefit over the long haul. It is critical to note that profits are not available when gotten, except if they surpass the all-out charges paid into the strategy.

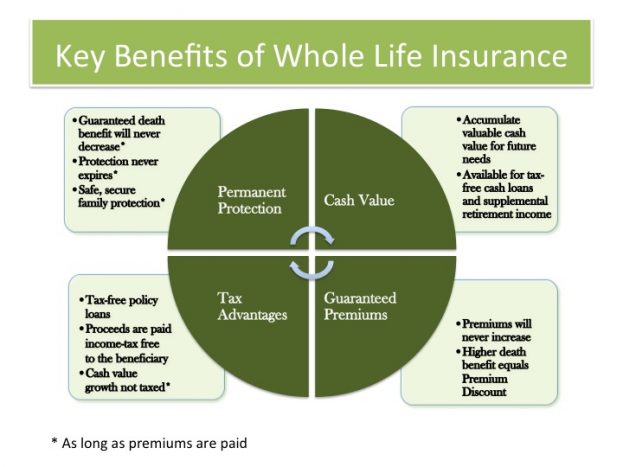

Benefits of Whole Life Insurance

Here are several key reasons why choosing whole life insurance can be a wise decision:

- Consistent Premiums: One of the most appealing features of whole life insurance is the consistency of premiums. Unlike term life insurance, which may increase in cost over time, your premiums remain fixed throughout the life of the policy. This predictability makes budgeting easier and ensures that your coverage won’t become unaffordable as you age. The only time you may choose to increase your premium is if you want to raise the cash value of your policy.

- Guaranteed Death Benefit: Whole life insurance provides a death benefit that is guaranteed to be paid to your beneficiaries upon your passing. This benefit is not subject to market fluctuations or changes, giving your loved ones financial security when they need it most.

- Cash Value Growth: Whole-life policies accumulate cash value at a guaranteed rate over time. This cash value grows in a secure, tax-deferred account, meaning you won’t pay taxes on the growth until you withdraw it. This feature can serve as a financial asset that may be used for various purposes, such as covering emergencies or supplementing retirement savings.

- Lifetime Coverage: Unlike term life insurance, which expires after a certain period, whole life insurance provides coverage for your entire life. You do not need to worry about outliving your policy, as your coverage continues as long as you continue paying premiums.

- Access to Cash Value: Another significant benefit of whole life insurance is the ability to access the cash value of your policy before it expires. You can borrow against the cash value, take a partial withdrawal, or even use it to pay premiums if necessary. While loans and withdrawals can reduce the death benefit, this flexibility allows you to tap into the policy’s value during your lifetime if you encounter financial challenges.

Loans Against Cash Value

Entire disaster protection approaches permit policyholders to borrow against the amassed cash value. This can be an appealing choice for people who need access to reserves yet don’t want to sell speculations or take out customary credits. Advances against the money value generally accompany lower financing costs than other sorts of advances, and there are no credit checks involved.

In any case, it’s critical that any advance equilibrium, including interest, is deducted from the passing advantage if not reimbursed. While getting from the money’s worth can be a valuable monetary device, it can diminish how much cash is left for recipients. Moreover, on the off chance that advances are not reimbursed, the approach could ultimately slip by, and the demise advantage would presently not be accessible.

Flexibility and Customization

Entire disaster protection strategies offer a level of adaptability and customization, which can be hell for policyholders with changing monetary requirements. Most entire-lifeapproaentire-life approaches to change the inclusion or premium installments through choices like ssettled-upincremsettled-incrementsxample, policyholders can utilize their profits to buy extra inclusion, which can build the passing advantage and money esteem after some time.

Pros and Cons of Whole Life Insurance

Pros:

- Lifetime Coverage: Whole life insurance provides guaranteed protection for the insured’s entire life, unlike term policies that expire after a set period.

- Cash Value Accumulation: The policy’s cash value grows over time, creating a financial asset that can be accessed for loans or withdrawals.

- Predictable Premiums: Premiums remain fixed throughout the policyholder’s life, which helps with long-term financial planning.

- Tax-Deferred Growth: The cash value grows tax-deferred, providing a long-term savings mechanism.

- Potential Dividends: Many whole-life policies offer dividends that can enhance the policy’s value or reduce premiums.

Cons:

- Higher Premiums: Whole life insurance premiums are higher than those of term life insurance, making it a less affordable option for some individuals.

- Slow Cash Value Growth: Cash value accumulation is often slow in the early years, and it may take a decade or more to see substantial growth.

- Complexity: Whole life insurance policies can be complicated, and the combination of insurance coverage, cash value, and dividends can be challenging to understand for some people.

- Lower Returns: The guaranteed interest rate on the cash value is often lower than other investment options, such as stocks or mutual funds.

Frequently Asked Questions

What is entire disaster protection?

Entire disaster protection is long-lasting extra security that includes your whole life, regardless of how long expenses are paid. It likewise builds cash esteem over the long haul, which develops at a surefire rate.

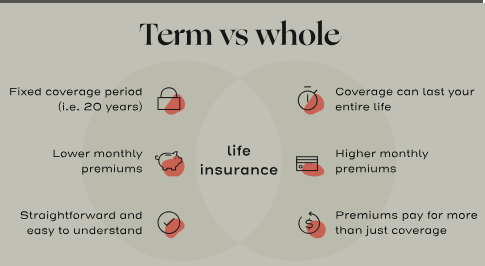

How does entire extra security vary from term life coverage?

Unlike term disaster protection, which offers coverage for a predefined period (e.g., 10, 20, or 30 years), entire extra security provides coverage for life. It additionally builds cash esteem, while term life approaches don’t.

Are charges fixed in entire disaster protection?

Indeed, the charges for the entire extra security are fixed and don’t increase as you age. This consistency makes planning simpler, and your expenses continue as before over the lifetime of the approach.

What is the money worth of an entire disaster protection strategy?

Money esteem is the top-notch piece of your business that gathers over the long haul and develops at a reliable rate. You can get against or pull out from your money esteem during your lifetime; however, it might decrease the benefit of demise.

Can I get to the money worth of my entire life strategy?

Indeed, you can get to the money worth of your strategy through credits or withdrawals. Nonetheless, any advances or withdrawals might lessen the passing advantage and may build interest.

Is the passing advantage ensured?

Indeed, the demise benefit will be paid to your beneficiaries when your die charges are paid, and the arrangement remains in force.

What occurs, assuming I quit paying expenses?

If you stop paying expenses, your strategy might expire or be reduced to a settled-up plan with a more modest demise benefit. Nonetheless, if your strategy has collected sufficient money esteem, it could be utilized to pay charges for a while.

How long does entire disaster protection endure?

Entire life coverage includes your whole life, for however long charges are paid. There is no lapse date, and your recipients will get the demise benefit upon your passing.

Conclusion

Entire extra security offers deep-rooted assurance, fixed expenses, and the chance to assemble cash esteem after some time. It may be a strong monetary instrument for long long-hauling, giving not just a reliable passing advantage for your friends and family but additionally a wellspring of financial security through its money esteem. While it might have higher expenses than term life coverage, the benefits of lifetime inclusion, steadiness, and the capacity to get to cash esteem make it an alluring choice for some people searching for enduring monetary assurance.