Whole life insurance for families offers an extensive and long-haul monetary insurance arrangement, guaranteeing inner serenity for friends and family. Dissimilar to term life coverage, which gives inclusion to a particular period, entire disaster protection offers lifetime inclusion for however long charges are paid. This sort of strategy provides a demise with an advantage to recipients as well as gathers cash esteem over the long haul, which can be acquired against or utilized for other monetary requirements.

For families, entire life coverage can be a fundamental device for shielding monetary solidness, assisting with taking care of memorial service costs, extraordinary obligations, and future everyday costs in case of a relative’s passing. Moreover, it can act as a type of constrained investment fund, giving a solid monetary resource that develops throughout the long term. Entire life coverage is exceptional for families looking for extended haul security, as it ensures insurance and fabricates esteem throughout the policyholder’s life.

What Is Whole Life Insurance?

Entire disaster protection is a kind of long-lasting extra security that includes the whole lifetime of the policyholder, for however long charges are paid. Dissimilar to the term disaster protection, which lapses following a set number of years, entire life coverage doesn’t have a termination date. One of the critical elements of extra security is its money esteem, which develops after some time as a piece of the expenses contributed by the insurance agency.

The policyholder can get against this money esteem or pull it out under specific circumstances. This makes entire disaster protection a passing advantage strategy, yet additionally a monetary device for reserve funds and ventures.

Why Families Choose Whole Life Insurance

Families ordinarily pick entire extra security in light of multiple factors, fundamentally itsdrawn-outt monetary advantages. One of the most convincing reasons is the financial security it offers. In case of the policyholder’s demise, the recipients will get a surefire passing advantage, which can assist with covering everyday costs, remarkable obligations, and other monetary commitments. This guarantees that the family isn’t troubled by financial difficulties during a troublesome time.

Another explanation families pickfor their entire life coverage is money esteem gathering. As the policyholder pays expenses, a part of the cash goes into an investment account that develops over the long haul. This money can be gotten in the midst of hardship, whether for taking care of obligations, subsidizing a youngster’s schooling, or covering crisis costs. Moreover, entire life coverage can be a monetary arranging instrument, assisting families with creating financial well-being over the long haul.

Key Features of Whole Life Insurance

- Guaranteed Death Benefit: The death benefit is paid out to the beneficiaries, and it is guaranteed as long as the policy remains active. Protected, no matter when you pass away.

- Cash Value Growth: The policy’s cash value grows over time at a guaranteed rate set by the insurer. This cash value is tax-deferred, meaning it grows without incurring taxes until you access it.

- Fixed Premiums: Unlike term life insurance, where premiums can increase after the initial term, whole life insurance has fixed premiums that remain the same throughout the life of the policy. This makes it easier for families to budget and plan for the long term.

- Dividends (in Participating Policies): Some whole life policies are “participating,” meaning they are eligible to receive dividends from the insurer’s profits.

How Whole Life Insurance Differs from Term Life Insurance

- Duration: Whole life insurance provides coverage for the policyholder’s entire life, whereas term life insurance provides coverage only for a specified period (e.g., 10, 20, or 30 years). Once the term expires, the policyholder must either renew the policy or let it lapse.

- Premiums: Whole life insurance premiums are higher than those for term life insurance because the policy provides lifelong coverage and builds cash value. Term life premiums, on the other hand, are typically lower, but they do not accumulate any cash value.

- Cash Value: Whole life insurance includes a savings or investment component, which grows over time, while term life insurance does not. Term life is purely focused on providing a death benefit, with no financial accumulation during the policyholder’s lifetime.

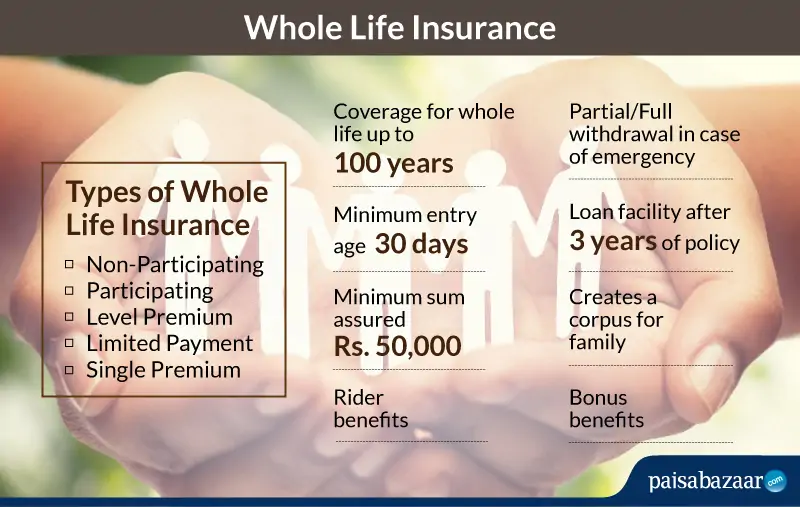

Types of Whole Life Insurance for Families

There are several types of whole life insurance policies that families can choose from, each with different features:

- Traditional Whole Life Insurance: This is the standard whole life policy, offering fixed premiums, a guaranteed death benefit, and a cash value component that grows over time.

- Limited Payment Whole Life Insurance: In this type of policy, the policyholder pays premiums for a limited number of years (e.g., 10, 20, or 30 years) instead of for their entire lifetime. After the payment period ends, the policy remains in force, and the death benefit continues to be guaranteed.

- Single-Premium Whole Life Insurance: This type of policy requires a one-time lump sum payment, which covers the entire premium for the life of the policy. It is an attractive option for those with a large sum of money available to invest.

- Participating Whole Life Insurance: This policy allows the policyholder to receive dividends based on the insurer’s financial performance. These dividends can be used to purchase additional coverage, reduce premiums, or be taken as cash.

Benefits of Whole Life Insurance for Families

Whole life insurance offers numerous benefits for families:

- Financial Protection for Dependents: The guaranteed death benefit ensures that your family will be financially supported after your death, helping them cover expenses like mortgage payments, funeral costs, and ongoing living expenses.

- Cash Value Growth: The policy’s cash value can be used as a financial resource in times of need. It can be borrowed against for major expenses such as home renovations, college tuition, or starting a business.

- Estate Planning: Whole ensuring that the family’s assets are preserved for future generations.

- Peace of Mind: Knowing that your family will be financially secure no matter what happens can provide peace of mind, especially for parents with young children or families with significant financial obligations.

How Cash Value Works

One of the most appealing features of whole life insurance is its cash value. As you pay premiums, a portion of the money is set aside in a cash value account. This account grows over time at a guaranteed rate set by the insurance company.

- Loans: You can borrow against the cash value of the policy, usually at a low-interest rate. The loan does not have to be repaid, death benefit.

- Withdrawals: You can also make partial withdrawals from the cash value. However, withdrawing funds may reduce the death benefit and may have tax implications.

- Premium Payments: In some cases, the cash value can be used to pay premiums, allowing the policyholder to reduce out-of-pocket expenses.

Costs of Whole Life Insurance

- Age and Health: The younger and healthier you are when you purchase the policy, the lower your premiums will be.

- Coverage Amount: The larger the death benefit, the higher the premiums will be.

- Policy Type: Certain types of whole life insurance, such as participating policies, may have higher premiums due to the potential for dividends.

- Additional Riders: Riders, such as a waiver of premium or accidental death benefit, can increase the cost of the policy.

While the premiums are higher, many families find that the long-term benefits of whole life insurance outweigh the initial cost.

Is Whole Life Insurance Worth It for Families?

- Want permanent coverage that lasts a lifetime.

- Need a financial tool that combines insurance protection with savings and investment.

- Are looking for guaranteed financial security for their loved ones.

- Have the financial capacity to handle higher premiums in exchange for the long-term benefits.

For families that need temporary coverage or are on a tight budget, term life insurance may be a more affordable option. However, for those who can afford it, whole life insurance offers significant advantages in terms of financial security and wealth accumulation.

How to Choose the Right Policy

Choosing the right whole life insurance policy for your family involves several key steps:

- Assess Your Needs: Consider the financial needs of your family, including how much coverage is required to cover debts, living expenses, and future goals like education.

- Evaluate Your Budget: Whole life insurance premiums can be expensive, so ensure that the premiums fit comfortably within your budget.

- Research Insurers: Look for reputable insurers with strong financial ratings. Compare policies from different companies to find the best coverage for your needs.

- Consider Riders: Riders are additional features that can be added to the policy. For example, a child rider can provide coverage for your children, and a waiver of premium rider can ensure that premiums are waived if you become disabled.

Tax Advantages of Whole Life Insurance

Whole life insurance offers several tax advantages:

- Tax-Free Death Benefit: The death benefit paid to your beneficiaries is generally tax-free, which means they will receive the full amount without having to pay taxes on it.

- Tax-Deferred Cash Value Growth: The cash value within the policy grows tax-deferred, meaning you don’t have to pay taxes on the growth until you withdraw it or take a loan against it.

- Loan Flexibility: Loans taken against the cash value are not taxable, though they may accrue interest. However, if the loan is not repaid, it will be deducted from the death benefit.

Common Misconceptions About Whole Life Insurance

There are several misconceptions about whole life insurance that can make families hesitant to purchase it:

- It’s Too Expensive: While whole life insurance is more expensive than term life, it provides permanent coverage and a cash value component, which can be a valuable long-term investment.

- It’s Complicated: Whole life insurance policies can seem complex, but working with a financial advisor can help simplify the process and ensure that the policy aligns with your family’s needs.

- It Doesn’t Offer Flexibility: While whole life insurance policies have fixed premiums, many modern policies offer flexibility in terms of premium payments and the ability to access the cash value.

Frequently Asked Questions

What is entire life coverage?

Entire disaster protection is a sort of long-lasting life coverage that includes the policyholder’s whole life and incorporates a part of money esteem.

How does the entire extra security function for families?

Entire life coverage guarantees monetary insurance for relatives by giving a passing advantage and collecting cash esteem over the long run.

What are the advantages of disaster protection for families?

It offers lifetime inclusion, monetary security, a reliable demise benefit, and money esteem that can be acquired against or utilized in crises.

Is entire life coverage more costly than term life coverage?

Indeed, entire disaster protection regularly has higher expenses because of its lifetime inclusion and money esteem aggregation.

Might the money at any point be gotten during the policyholder’s lifetime?

Indeed, the money worth can be acquired against or removed. However, credits accumulate revenue and lessen the demise benefit.

Does the entire extra security gather cash esteem?

Indeed, some of the premium goes toward building cash esteem, which develops over the long run on a duty-concessioned basis.

Is entire life coverage reasonable for all families?

Whole life insurance is excellent for families looking for long-term monetary security, but it may not be vital for those with momentary needs.

How is the demise benefit paid to recipients?

Could I, chang my in,clusion cautionEntire extra security approaches commonly have fixed inclusion sums. However, a few strategies might offer choices for changes or extra riders.

How long do I have to pay the charges?

Expenses are commonly paid throughout the policyholder’s life, but some strategies offer restricted premium installment choices.

Conclusion

Entire extra security offers families deep-rooted monetary assurance, guaranteeing that friends and family are upheld in the midst of hardship. With its double advantages of lifetime inclusion and money esteem gathering, it gives a security net to both prompt and long-haul monetary objectives. While the expenses are higher than those for term disaster protection, the reliable demise advantage and capacity to get to cash esteem are essential important devices for families searching for steadiness and security. Entire life coverage can likewise act as a venture, filling in esteem over the long run and offering monetary adaptability. For families focused on getting their monetary future, entire life coverage is a powerful arrangement that adjusts security and establishes financial stability.