The insurance market is currently experiencing critical difficulties for customers, with rising charges, befuddling contract terms, and an absence of straightforwardness. Many individuals are finding it progressively challenging to explore the complicated landscape of protection choices, which prompts disappointment and monetary strain.

With guarantors focusing on benefits over consumer loyalty, policyholders frequently feel overpowered and misguided, making it hard to settle on informed decisions. To resolve these issues, changes are expected to guarantee more noteworthy straightforwardness, contest, and shopper security. Working on approach language, offering clearer examinations, and implementing stricter guidelines on premium increments can assist with evening the odds.

Reduction of Premium Costs

One of the most quick and squeezing worries for purchasers in the insurance market is the increasing expense of payments. For some people and families, paying for protection is turning into an inexorably tricky cost. Medical coverage expenses, for instance, have been consistently expanding, while auto and home protection are much the same way on the ascent.

The variables driving these increments incorporate expansion, higher case payouts, and more continuous catastrophic events. Insurance agencies should find ways of diminishing charges, either through better gambling on the board, more proficient case handling, or utilizing innovation to survey risk more precisely. Bringing down expenses without forfeiting inclusion would make protection more reasonable for a wider range of customers, particularly those who are presently overestimated.

Simplification of Policy Terms

Insurance contracts are famously perplexing, loaded up with language, prohibitions, and fine print that the typical purchaser battles to decipher. The thick lawful language utilized in many approaches can leave individuals feeling confounded and uncertain of what they’re really covered for. This intricacy frequently brings about customers buying protection they don’t ultimately have the foggiest idea or, more terrible, neglecting to acknowledge they’re underinsured.

Safety net providers need to work on arrangement language, utilizing plain and direct terms that are simple for the typical individual to comprehend. Thus, buyers would be better prepared to arrive at informed conclusions about their inclusion, guaranteeing they’re sufficiently safeguarded without being overpowered by confounding subtleties.

Transparency in Pricing

One more critical issue in the protection market is the absence of straightforwardness in estimating. Purchasers frequently fail to see the reason why their expenses are set at specific levels, and they might feel that valuing is erratic or conflicting. Guarantors should be more straightforward about how things are not entirely settled, framing the particular factors that impact evaluation, like age, area, driving history, or case history.

More clear clarifications about why certain charges are higher or lower could assist consumers with better surveying their choices and pursuing more educated decisions. Also, offering apparatuses that permit shoppers to think about approaches and evaluate across vendors can help drive contests and lead to additional reasonable rates for everybody.

Improved Claims Process

One of the most baffling parts of managing protection is the case interaction. For some shoppers, recording a case is a tedious and distressing experience, frequently including long deferrals, indistinct directions, and an absence of correspondence from the safety net provider.

At times, claims are denied without sufficient clarification, leaving clients feeling vulnerable and disappointed. To resolve this issue, insuranagenciesncy should smooth out case interactions, making it quicker, more straightforward, and more uncomplicated to explore.

The Complexity of Insurance Policies

- Unclear Terms and ConditionsUse of jargon and technical language that consumers find hard to understand.

- The role of digital support and customer service in modernizing the insurance experience.

- Lack of transparency regarding coverage, exclusions, and limitations.

- Lengthy and Confusing ContractsLength of policies and the overwhelming amount of fine print.

- Importance of simplifying policy documents for consumer understanding.

- Inadequate Customer support difficulty in obtaining clear and helpful answers from insurers.

The Impact of Rising Premiums

- Increased Costs for Consumers: How rising premiums are squeezing household budgets.

- Effect of inflation, claims frequency, and market volatility on premiums.

- Inconsistent Pricing and Discriminatory PracticesPricing based on risk factors, demographics, and previous claims.

- Gender, age, and geographical pricing disparities.

- Affordability Crisis: The challenge of maintaining comprehensive coverage in the face of increasing costs.

- Impact on low-income households and vulnerable populations.

The Fragmentation of Insurance Products

- Diverse Insurance Categories: Various types of insurance (life, health, auto, home, etc.) and the complexity they bring.

- Consumers need to navigate multiple policies with varying terms and coverage.

- Bundling and Cross-Selling Pressure: The practice of cross-selling additional products and the consumers’ lack of clarity on what they really need.

- Challenges in understanding and selecting suitable combinations of policies.

The Claims Process: A Major Hurdle for Consumers

- Claim Denials and DelaysCommon reasons for claim rejections and the consumer frustration that follows.

- Case studies highlighting negative claim experiences.

- Lengthy and Complex Procedures: The time-consuming nature of filing a claim and the bureaucratic hurdles.

- How inefficient claims processes affect consumers’ well-being.

- Lack of Accountability and TransparencyThe role of insurance companies is to provide clear communication during the claims process.

- Accountability gaps in insurance companies’ practices.

Limited Accessibility to Insurance Products

- Geographic and Socioeconomic Barriers: The difficulties faced by people in rural areas or lower-income communities in accessing affordable insurance.

- Insurance deserts: regions where insurance is not readily available.

- Exclusionary Practices and BiasDiscriminatory practices based on race, gender, age, or other factors.

- Barriers for people with pre-existing conditions in accessing health or life insurance.

- Digital Divide and Technological Access: The importance of making insurance accessible through digital platforms.

- Challenges faced by older adults or those in developing regions in accessing online services.

The Role of Technology in the Modern Insurance Market

- Insurtech: The Digital Disruption of Traditional Insurance. How new technology is changing the landscape: AI, blockchain, and big data.

- Opportunities and challenges presented by insurance.

- Streamlining the Buying ProcessThe role of digital tools in simplifying insurance purchases and policy comparison.

- Examples of consumer-friendly insurtech apps and platforms.

- Personalized Insurance Products Through Data Analytics: The use of customer data to create customized insurance offerings.

- How can data-driven insights improve both affordability and coverage quality?

- The Role of Artificial Intelligence in Claims and Customer Support: How AI can expedite the claims process and improve customer service.

- Potential concerns regarding data privacy and algorithmic bias.

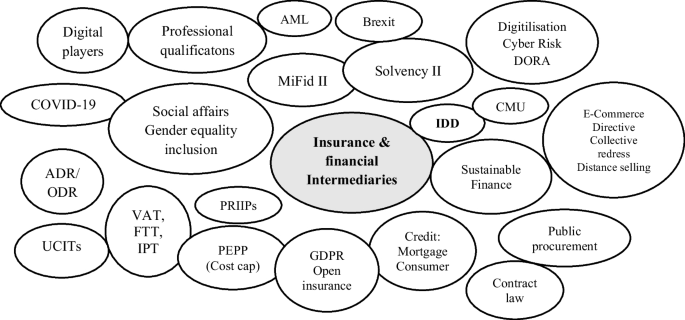

Regulatory Oversight and Consumer Protection

- Government Regulations on Insurance MarketsThe role of governments in regulating the insurance market is to protect consumers.

- Overview of consumer protection laws and regulations (e.g., GDPR, ACA).

- Insurance Market Transparency: How can regulatory bodies improve market transparency to enhance competition and reduce consumer confusion?

- 8 The Role of Consumer Advocacy Groups There is a need for independent organizations that advocate for consumer rights within the insurance space.

- Case studies of successful consumer advocacy campaigns.

- Ensuring Fair Practices and Eliminating Fraud: How regulators can help prevent fraud in the insurance industry and protect consumers.

- The role of consumer education in preventing fraudulent schemes.

The Future of Insurance: What Needs to Happen

- Simplification of Policies and ProcessesMoving towards clear, easy-to-understand policies.

- The importance of transparency and simplified claims procedures.

- Efforts to Make Insurance More Affordable and AccessibleHow insurers can lower costs through innovation and better risk management.

- Creating flexible and inclusive options for diverse consumer groups.

- 9.3 Enhanced Use of Technology to Benefit ConsumersIncreasing reliance on technology to streamline administrative processes, offer personalized products and expedite claims.

- Encouraging insurers to adopt digital tools that make the consumer experience smoother and more efficient.

- Greater Consumer Education and SupportStrategies for educating consumers about insurance products and their rights.

- There is a need for accessible, clear resources and support systems.

- Improved Regulations and Enforcement: Strengthening government oversight to hold insurers accountable.

- Advocating for stricter penalties for malpractices and more robust consumer protection laws.

Frequently Asked Questions

For what reason is the protection market challenging for shoppers?

The insurance market is confounded by complex contracts, rising charges, and hidden expenses, making it difficult for shoppers to comprehend and evaluate their options.

How do rising expenses influence purchasers?

Charges are increasing, frequently past expansion rates, which is affecting purchasers, particularly those with restricted budgets.

Which job does strategy intricacy play?

Confusing agreements make it hard for buyers to understand what they are covered for, prompting misconceptions and disappointment.

Are insurance agencies straightforward?

Numerous guarantors need transparency in valuation and guarantee processes, which can leave buyers in a state of obscurity about what they’re paying for.

How does the absence of a contest influence shoppers?

Restricted rivalry results in more exorbitant costs and fewer decisions for purchasers, making it harder to determine reasonable and appropriate inclusion.

How might insurance contracts be improved?

Improving strategy language and offering clearer examinations can assist shoppers in making better choices.

What assurances ought to be set up for shoppers?

More grounded guidelines are expected to forestall unjustifiable evaluation and guarantee fair case handling.

Might innovation further develop the protection market at any point?

Indeed, involving computerized stages for straightforwardness and simple correlation could make the interaction more available and shopper amicable.

Conclusion

Changes are vital to facilitating the challenges shoppers face in the protection market. Working on strategies, improving transparency, and expanding rivalry will help establish a more shopper-friendly climate. More grounded guidelines and the utilization of innovation can also further develop openness, reasonableness, and trust. Eventually, a more straightforward and impartial protection market is expected to reestablish customer certainty and guarantee fair security.